These stories exemplify the outreach and referral work of Valley Health Connections in Springfield, Vermont: work that saves lives and protects patients from serious financial hardship.

Valley Health Connections

Springfield, Vermont

Loretta*, a 76-year-old Vermonter on Medicare, was stressed and struggling with major health and financial issues. Mandy*, an uninsured woman facing surgery and a regimen of expensive medications after the holidays, missed the year-end, open enrollment deadline to sign up for insurance through Vermont Health Connect.

Together, their stories exemplify the outreach and referral work of Valley Health Connections in Springfield, Vermont: work that saves lives and protects patients from serious financial hardship.

Loretta’s Story: Providing a Pathway to Health and Financial Security

Facing a number of significant health issues, Loretta reached the reluctant decision to step down from her job as a care provider when her client found a long-term placement last fall. At 76, Loretta’s health was deteriorating and she’d recently spent a significant amount of time in the hospital. She was deeply concerned about the impact of her declining health on her physical, mental, and financial well-being. That’s when she reached out to Valley Health Connections for assistance, although uncertain if the free referral clinic could do anything to help her.

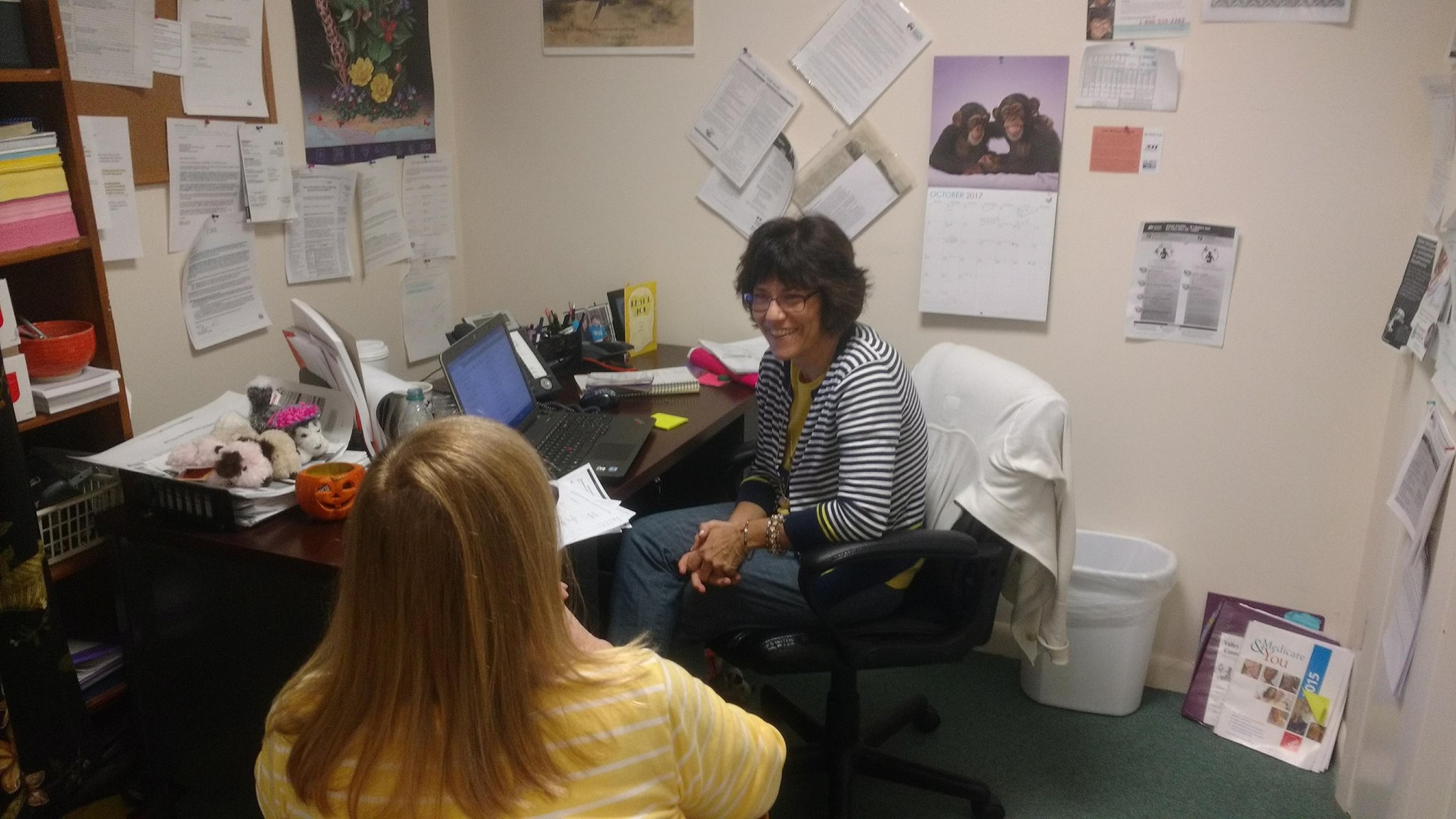

“After a five-minute intake interview over the telephone, it was clear that there were a number of programs available to help Loretta,” explained Lynn Raymond-Empey, the executive director of Valley Health Connections. “We got the process started by having Loretta gather her income verification and insurance information, including a detailed list of her medications. And then she came in for a face-to-face appointment, where our work with her really began in earnest.”

Valley Health Connections assisted Loretta in applying for a low-income subsidy to cover the cost of her Medicare Part D plan and reduce her copays for prescription drugs. The Springfield-based referral clinic also helped Loretta apply for the Medicare Savings program, which covers the cost of her Medicare Part B plan and can also help with coinsurance. In order for Loretta to qualify for these programs, Valley Health Connections had to help her over another frustrating barrier: she had to apply for unemployment insurance, even though she was physically unable to work anymore. “While we questioned the state about the senselessness of this requirement, we nonetheless completed the unemployment paperwork the very first day,” Raymond-Empey said.

All these efforts resulted in a significant decrease in Loretta’s out-of-pocket expenses for health care, as well as a marked reduction in her stress level, which itself was having a negative impact on her well-being. On a limited income of just $1,000 a month, Loretta was paying $135 a month for her Part B plan, $70 for a Part D plan, and $235 monthly for supplemental coverage she purchased when she first went on Medicare. With the assistance of Valley Health Connections, Loretta’s healthcare costs dropped by more than $200 a month – the equivalent of getting a 20% raise in her Social Security income.

“I just met with Loretta for a follow-up visit today,” Lynn Raymond-Empey said recently. “You could literally see the tension come out of her neck and shoulders. Some days are very good days at the clinic.”

Mandy’s Story: Following the Winding Road to Health Insurance

The open enrollment period for health insurance comes only once a year. It’s not only imperative to be a thoroughly trained assister in order to aid in enrollments through Vermont Health Connect: clinic staff must also have broad knowledge regarding other insurance options, including the process for direct enrollments through insurance carriers.

While it was widely advertised in 2019 that the Vermont Health Connect open enrollment period ran from November 1 through December 15, Valley Health Connections learned through its work with the state’s two insurance carriers that one of those insurers, MVP, was keeping its direct enrollment period for Vermonters without healthcare subsidies open until December 26. This proved to be a godsend for Mandy, who missed the opportunity to sign up for health insurance via Vermont Health Connect by the December 15 deadline. In any event, her income put her significantly out of range for subsidies.

When she contacted Valley Health Connections just before Christmas, Mandy was in panic mode: she faced surgery and a significant regimen of expensive medications after the first of the year, all without health insurance coverage in place. Valley Health Connections immediately asked Mandy to come into the clinic to review her direct-enrollment plan options and prices.

It was December 26 – Mandy’s very last opportunity to make an insurance decision for 2020. Valley Health Connections promptly provided Mandy with an application and instructions for completing direct enrollment through MVP. Not only was she able to enroll in a plan effective January 1 – Mandy also saved on monthly premium costs while opting for a plan that worked well with her upcoming specialist visits and impending surgery.

The extended direct-enrollment period for MVP was not well publicized, nor was that information provided through Vermont Health Connect. Without the expertise and assistance of Valley Health Connections, Mandy would have remained uninsured for another year.

“Our work and knowledge of all aspects of the system is imperative for the financial stability of our healthcare institutions and, more importantly, for the health of all Vermonters,” Vermont Health Connections Executive Director Lynn Raymond-Empey concluded. “It’s not just about being a low-income person or someone with no insurance. It’s about healthcare access for everyone.”

* The patient’s name has been changed to respect privacy, protect identity, and assure confidentiality.